A married couple have received jail time for abusing the Internal Revenue Service’s “Get Transcript” feature to commit fraud.

On 27 July, U.S. District Chief Judge Thomas W. Thrash Jr. for the Northern District of Georgia handed down sentences to the couple. The husband Anthony Alika, 42, will serve 80 months in prison and three years of supervised release. His wife Sonia will serve 21 months in prison and three years of supervised release.

The judge also ordered the couple to pay $1,963,251.75 and $245,790.08 in restitution to the IRS, respectively.

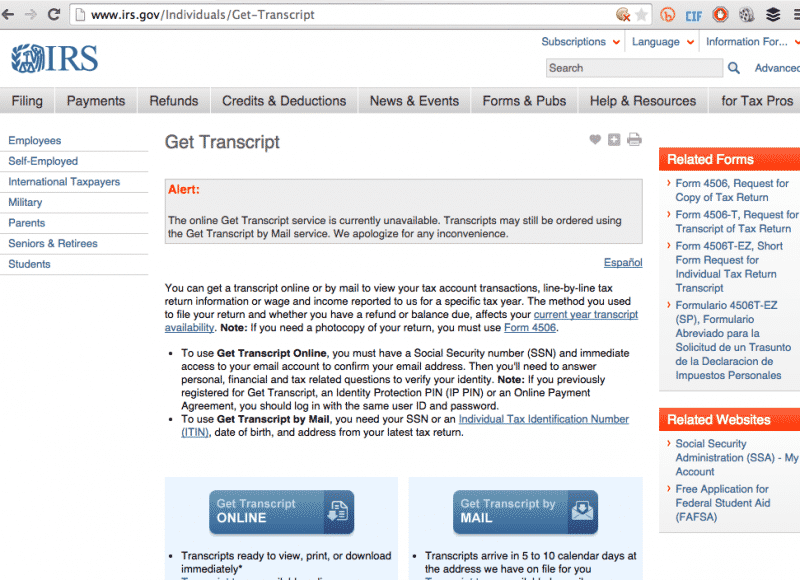

According to court documents, the couple leveraged people’s personally identifiable information (PII) to access the IRS “Get Transcript” database. They abused that service to file fake tax returns in those individuals’ names and directed the IRS to deposit any refunds onto prepaid debit cards they purchased. They then used those cards to purchase money orders that they deposited into their bank accounts.

The Alikas knew what they were doing, so they structured their cash withdrawals to avoid suspicion.

As the Department of Justice explains in a statement:

“As part of his guilty plea, Anthony Alika admitted that during 2015, he received money orders from several individuals and deposited them into bank accounts in his and his wife’s name. Anthony Alika structured the cash withdrawals from his bank accounts in amounts less than $10,000 to evade the bank reporting requirements. Anthony Alika admitted that the funds used to purchase the money orders were the proceeds of illegal activity, including the filing of fraudulent tax returns using stolen identities. Anthony Alika admitted that he laundered over $1.5 million. Sonia Alika admitted as part of her guilty plea that between February and June 2015, she withdrew more than $250,000 from multiple bank accounts she controlled in amounts less than $10,000 to prevent the bank from filing Currency Transaction Report (CTRs).”

In January, a federal court charged Anthony Alika with one count of conspiracy to commit money laundering and Sonia Alika with one count of conspiracy to structure money withdrawals so as to avoid bank reporting requirements.

About a month later, the IRS disabled its Get Transcript feature after it detected 200,000 attempts by which fraudsters attempted to use the service to file fake tax returns.

U.S. Attorney John A. Horn of the Northern District of Georgia feels the sentencing sends a message to tax fraudsters everywhere. As quoted in the DOJ statement:

“This fraud conspiracy featured a literal highlight reel of our current economic crime threats, including cyber intrusions, identity theft, phony tax returns and money laundering, all to the order of millions of dollars. These schemes create nightmares for citizens who endure the process of repairing their credit and IRS returns, and this case reflects law enforcement’s commitment to punish these criminals and do all we can to prevent further victims.”

To protect themselves against schemes similar to the one perpetrated by the Alikas, users should never share their tax-related PII–especially their Social Security Numbers–with anyone. They should also make an effort to file their tax returns early, which will prevent fraudsters from abusing their information.

Allowing the IRS to use pre-paid plastic to provide tax refunds should be stopped immediately. The scam outlined here could not have been accomplished without the use of the pre-paid cards. Each TIN must be limited to one refund, and it must be by paper check that requires photo ID to cash, or the refund must be sent electronically to a verified bank account which displays the identical TIN as on the filed tax return.

"To protect themselves against schemes similar to the one perpetrated by the Alikas, users should never share their tax-related PII–especially their Social Security Numbers–with anyone." Meanwhile you have to use your SS# as identification for virtually anything and everything even though it was sold as something that would never be used as identification.

What does it take to get our SS numbers off of our Medicare cards. These are handed to someone every time we visit a Doctor and used to file claims. Typical government idiocy.

All tax returns should be filed by a tax preparer in good standing with the IRS

self filing on the computer leads to a lot of fraud!

Ken C. you are an idiot. Must do tax returns for a living, I can see no other eason for this silly statement.

That is a false and uneducated statement. I've done my taxes via computer for the last 4 or 5 years without issue and will continue to do so.

I don't want to file early. I want to set a flag that my taxes absolutely will not be filed before March 1 and if they are, it is fraud.

Outstanding FOR ONCE, a government agency acted in the benefit of a Citizen. Damn that should be a national holiday .

Crowing about punishing one or two fraudsters (while allowing millions more to commit their fraud without consequence of any kind) simply means that potential fraudsters will just say, "It won't happen to me" and carry on their fraud. And if you're not physically in the continental United States, you basically have carte blanche to commit whatever Internet fraud you want with absolutely no consequence at all. There really needs to be a worldwide roundup and punishment of these crooks, but it will never happen.